Mobile banking has already gained tremendous popularity during the COVID-19 pandemic. However, the disruptions and limitations brought by the virus shifted banking from a novelty to a necessity.

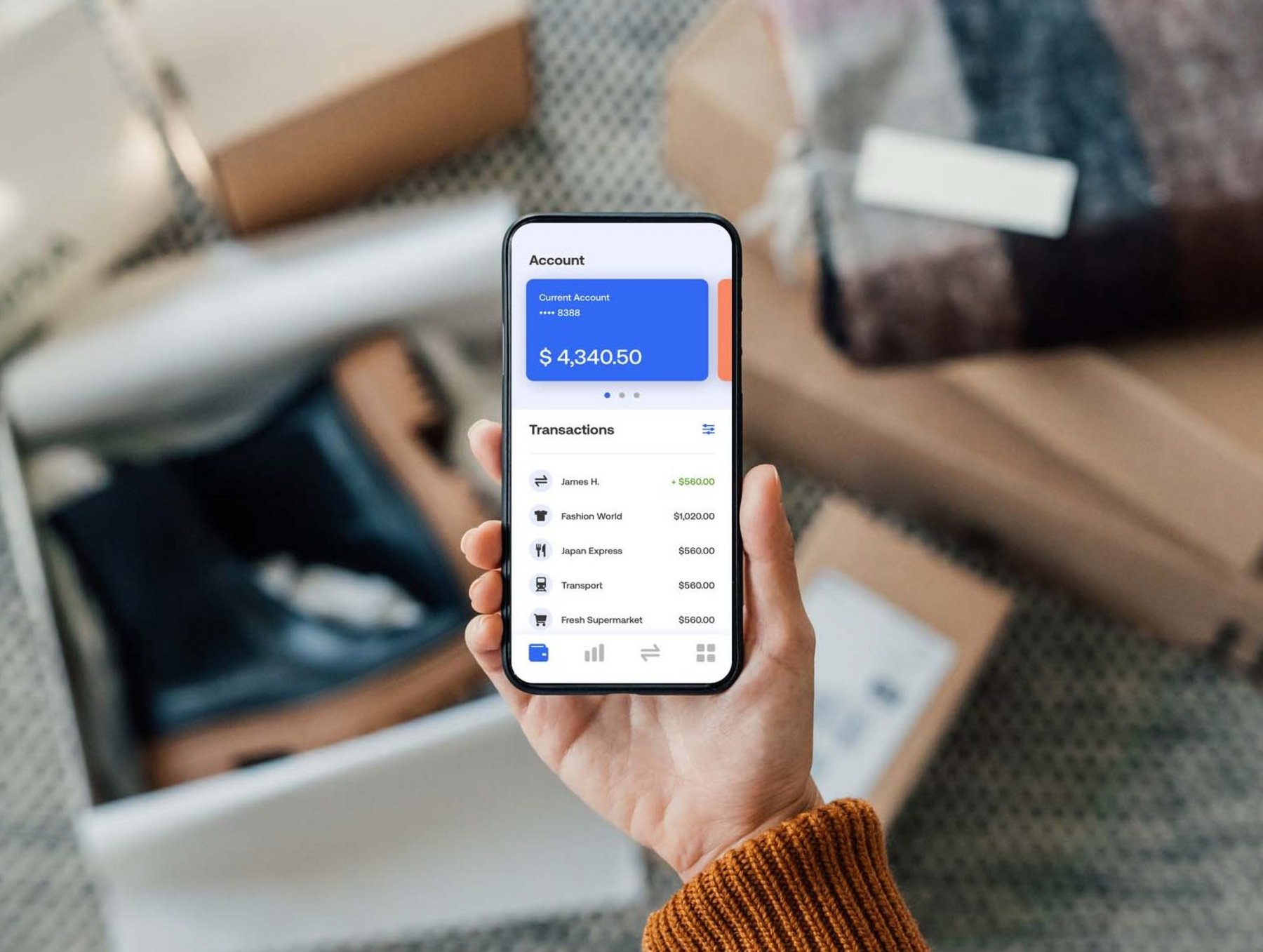

This is so because of the convenience that comes along with using facilities and services like mobile banking, credit card, etc. Customers can virtually carry their mobile phones anywhere and everywhere. Hence a mobile banking application can help them take care of their financial needs instantly at their convenience. To put it in simple words, it is a bank in your purse or pocket.

The significance of using mobile banking or a UPI app has become only more profound during a time wherein branch timings have been reduced and bank call centers do not remain open 24×7.

According to a survey, many banking consumers have switched to mobile banking applications, BHIM UPI, and so on for handling their bank accounts – thus making it the most trusted way to communicate with financial institutions.

Various leading banks with mobile banking applications such as Bank of India lets you stay aware during those times when you spend more than the amount you have in your account, transfer funds on their own into your savings account on your payday, and allow you to enable controls on your cards to limit spending. Banking applications can also make sending funds to friends simple or reach out to a customer service executive with a button.

Unlike a traditional bank branch, mobile banking lets you access your bank account anytime, with few exceptions, like planned maintenance-related information and unforeseen outages.

This accessibility, ease, and convenience help you in saving a lot of time. For instance, mobile check deposit, a feature offered by most banking apps, lets you deposit a check instantly from the comfort of your home.

Also, mobile banking can even diminish pandemic-related and other health concerns users might be going through when banking in person. Some of the best mobile banking apps have transformed in such a way as to allow you to handle your finances with minimal effort. Additionally, you can set spending alerts on your device, which can help you optimize your funds greatly.

Banks are responsible for safeguarding your assets and interests – which also consists of transactions conducted with the help of mobile apps. However, nothing is foolproof; there are several methods in which you can amp up security measures in case you are concerned regarding mobile banking safety or security.

Banks and other financial institutions frequently need a username and password for completing the signup process in a mobile application, and they also provide extra safety characteristics to safeguard your account. For instance, multi-factor authentication needs a minimum of two types of verification to prove it is you.

Such security features enable you to lock or remotely turn off your mobile phone if it goes missing to keep the fraudsters at bay. Your mobile banking app may also allow you to share your location to inform you about payment fraud.

Conclusion:

A mobile banking application for instance, Indian Bank and many others are created to assist you in all ways – a few of which are redefining the role of a bank to a great extent. The credits go to the 24×7 accounts access and the ability to conduct transactions with just a few clicks; users have gained greater control over handling their finances more efficiently with convenience.

Comments