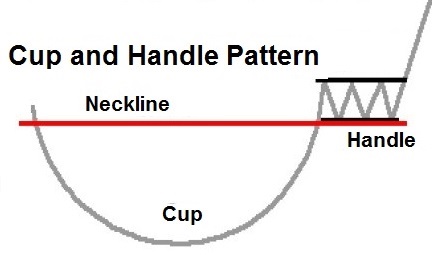

For those who are unfamiliar with the investment term, cup and handle refers to a certain pattern that crops up on price charts and indicates the occurrence of an upward trend, signaling to begin investing while prices are still low. A cup and handle form during a price fall. The beginning of the cup starts during a downward price trend. Once the price levels out at the bottom, it forms the bottom of the cup, which then goes upward as the price rises in order to form the other end of the cup. Once it reaches a certain point, the price trend will then lower slightly or continue on a level trend before going back up again. This short period right after the cup ends provides investors with the handle they are looking for.

Now that we’ve taken a look at what the cup and handle are, let’s dive into some valuable trading strategies that will help you make money off of this visual trend.

Only Enter the Cup and Handle at the End of the Handle

As was described above, there will be a short downward or level trend consisting after the peak of the cup has been reached. This is called the handle. Handles are usually indicative of a potential price rise, although this is not necessarily true each time. However, this trend can be observed and taken advantage of before a profitable price rise occurs. It may seem as though you should invest at the bottom of a cup to get more return on your investment once the rise occurs, but there is a reason why this is called the cup and handle. A cup on its own may not transform into a rising trend and you could end up losing money when you think the bottom of the cup is forming.

This is why you must pay attention to the charts and take notes of when the cup’s handle begins forming and when the price starts to rise. The point between the end of the handle and the beginning of the rising trend is when you need to begin trading as that point both confirms the cup and handle and lets you know that you are about to experience the rise in prices. You could also trade once the handle ends and right at the beginning price rise to maximize profits.

Set Up a Stop Loss to Protect Investments

It’s important that you prevent yourself from experiencing any losses, especially if a cup and handle trend doesn’t work the way you intended. To prevent losses when trading using this strategy, make sure to put a stop loss order right at the lowest price of the handle. If you invested shortly after the handle ended and prices began rising, you can then ensure that you won’t lose too much money and will minimize the amount of damage that might occur from a failed prediction.

Establish a Target Point for Trading and Bringing in Profits

If all looks well, the price should be rising quickly and surpassing the short spike that occurred right after the end of the handle. To make sure that you receive maximum profits for your trade, you need to establish a target point. When using the cup and handle technique, it is recommended that you take the peak of the beginning of the cup and double it. This is the price at which you should trade at. If it goes a little bit shorter and it looks as though it may go down again, it’s okay to settle for a little bit less if necessary.

The cup and handle technique is successful because it typically works to identify rising prices in a market. Using the three techniques above, you will be able to note these market trends and use them to your advantage!

Comments