You may think that running a small scale business is easy and taking care of the administration is of no big issue. But when the actual business takes off, you will find that there is hardly enough time to sort out the business operating expenses e.g. receipts for entertainment, petrol, business meals, and others. There is also the need to keep track of the rent, utility bills, and loans repayment etc. to settle.

Since yours is a small scale business, there is no urgent need to employ a staff just for the administrative work. But what you may need is a business expense app to help you track and manage the cash flow of your business. The business expense app will do all the tedious work of sorting out your expenses receipts for you in a faster and more accurate way.

You can choose from the many business expense app versions available to suit your business type and need. Most likely you may want to keep your business finances separate from your personal finances. Then you may like to try out the Spent Money finance app.

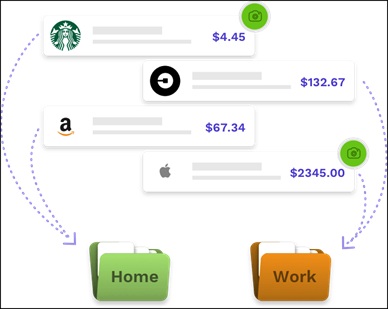

Spent Money app can act as your expense manager, receipt scanner, and personal finance tracker. It can easily manage all the business expenses and personal finances, at the same time help you earn some extra cash through cash back. These cash back can be earned from in-store and online shopping, simply by linking your credit card. It also tracks your spending, organizes purchases, scans receipts and also submits expense reports in real time through the app.

If you are using Spent Money app, it helps you earn cash back for both your business and personal purchases.

- Through the booking of hotels for both business and leisure travel

- Through purchases made at top stores and websites like Best Buy & Groupon

- Through purchases made at local shops and restaurants.

Spent Money app could be one of the best budget planner apps you can download from Play Store onto your smartphone to help you track purchases, receipts and etc.

- By creating customized folders

- By scanning of receipts through snapping of photos or emails.

- Importing your expenses

- Organizing and itemizing both your business and personal spending.

These budget planner apps works best for self-employed owners of small business and freelancers. Some of the key features of these apps are:

- User friendly mobile app

- Automatically earn cash back for your purchases

- Customize folders

- Manage and categorize simple personal finances and business expenses

- Scan and store receipts

- Automatically import bank and credit card transactions

- Calculate currency exchange

- Reports and analyses employee expense and individual spending.

Comments